Partner

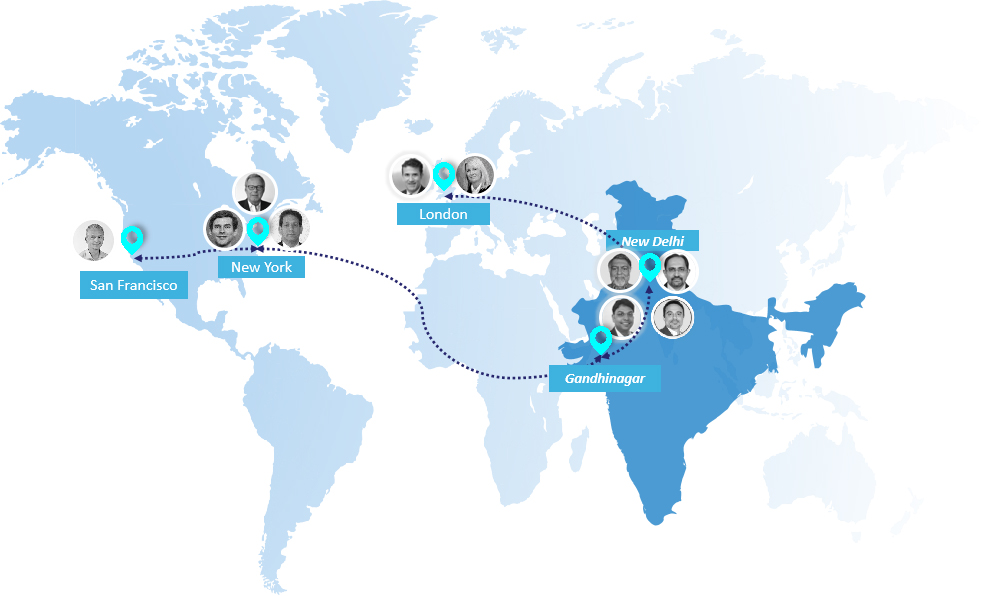

London, UK

Jo Mason is an experienced executive with 25+ years in leading corporate transformations, with extensive hands-on experience with M&A activity leading day one integration of acquisition and merger companies. She is COO of The Lawrie Group (TLG), a private company providing consulting services on value creation and enterprise transformation, and investment management services. She has worked with organizations to drive execution of strategic initiative, transformation and process reengineering within all areas of the business including HR, finance, delivery, sales and IT.

Jo previously served as Executive VP and Chief Human Resources Officer of DXC after completion of the HPES Merger. Jo’s work as a global CHRO included leading all aspects of human resources, including talent recruitment, retention, workforce development and organization effectiveness, as well as policy, benefits and compensation transformation.

Prior to joining DXC, she served as Chief Human Resource Officer and VP of CSC, after joining the firm as the Chief of Staff and Head of Change Management and Execution Office. Prior to joining CSC, Jo was Chief of Staff and Operation Director at Misys plc. Ms. Mason is an executive sponsor of global diversity and inclusion programs driving cultural change

Founder & Senior Partner

London, UK

Ramesh is strategic management and investment professional with 30+ years experience. He has spent 15+ years in running private equity firms across Asia, Europe and Middle East. Currently, he runs Avest, a private equity firm advising a UAE-based sovereign fund as well as making direct investments in Asia.

Previously, he ran Samena Capital’s PE business with $500 mn AUM; served on Investment Committee, Board and Executive Committees; and on boards of several investee companies. He was Managing Director at Bridgepoint Capital, leading European mid-market buyout firm; led large tech/digital buyouts in Europe and follow-on Indian joint ventures for portfolio companies. He was a Partner with McKinsey‘s New York and Mumbai offices; led the firm’s High Tech and Telecom practice for Asia.

Currently, he serves on boards of Pure Data Centers, RAK Economic Zone, RAK Airport, ATCO Group, Spice Money, Wall Street Finance and Falcon Technologies

Partner

New York

Dan Fenster is the Chief Administrative Officer and head of Investor Relations for The Lawrie Group (TLG), a private investment management services company, currently with $70m of AUM in investment strategy. Dan has over 25 years of operational and administrative experience across the alternative asset industry and joined TLG after serving as the Chief Operating Officer for an Asian based commercial multi-family office. Prior to that, Dan served as Vice President of Operations at Credit Suisse Asset Management, having joined CS after filling a similar role with Julius Baer Investment Management.

Dan began his career in alternative investments as the head of operations and administration for the Alpha group of companies, a Swiss, New York, and Bermuda based fund of hedge funds company. Dan holds a Bachelor of Science degree in Economics from Purdue University.

Partner

New York

Jonathan Morris is an Investment Partner at The Lawrie Group (TLG), a private investment management services company, currently with $70m of AUM in investment strategy.

Prior to joining TLG, Jonathan led principal investments and structuring at a large family office, which has signed over $1.3 billion of committed capital agreements. Prior to that, Jonathan was with the Blackstone Group where he oversaw several transactions and from 2012-16 served on the Board of SunGard AS. Before joining Blackstone, Jonathan was in the TMT Investment Banking Group of Credit Suisse where he successfully completed transactions with a combined value of ~100 billion.

Jonathan was a founder of GAIN Capital, a start-up which successfully went public. Jonathan began his career with Lombard Odier, a private Swiss bank where he worked as a private equity analyst. Jonathan has a Bachelor of Science in Economics and Finance from the University of Virginia and an MBA from Georgetown University.

Advisory Partner and Chairman of

IC Bay Area, San Fancisco

George is a senior global business leader with 4 decades of leadership experience across tech investing, tech and management consulting. He is founding partner at Sumeru Equity Partners – a mid market growth stage Private equity firm (an offshoot of Silverlake), with over $3bn investment in more than 50 private enterprise technology companies and platforms. He is focused on SaaS (both vertical & horizontal), Cyber/Infra/Analytics, Spend Management, EdTech, investing. Previously, he was Executive Vice President at HP Software (where he led HP’s $4-bn software portfolio) & Strategic Relationships (where he was responsible for leading growth initiatives/alliance programs with key partners, service providers & HP’s largest customers). He served as Operating Partner at Silver Lake, a global tech investment firm ($14 bn + AUM) where he was responsible for driving growth & operational improvement across a wide range of portfolio companies. His previous experience includes role of Vice President and General Manager at IBM, Chairman and CEO of Corio, Senior Vice President at Oracle and Senior Associate at Booz-Allen Hamilton

Senior Partner

New York

Mike is a globally recognized business and technology leader, strategist and change-agent with proven success in transforming enterprises to create growth, new market opportunities and value for stakeholders, with more than 40 years of management experience. He is founder and CEO of The Lawrie Group (TLG), a private company providing consulting services on value creation and enterprise transformation, and investment management services. Currently, with $70m of AUM in investment strategy. Mike served as chairman and CEO of three public companies – DXC Technology Company (NYSE:DXC, $20bn fortune 500 company after the merger of HPE eneprise services and CSC), Misys plc and Siebel Systems Inc. He is former partner of ValueAct Capital and former SVP & group executive at IBM – responsible for sales and distribution of all IBM products and services worldwide. He has decades of public company board experience including as chairman of the board of directors of Perspecta (NYSE: PRSP)

CFO & Chief Portfolio Manager

New Delhi

Anurag has had a career in Operations, Portfolio Management, Finance & Accounts, Regulatory, Compliance and Legal with over 34 years of corporate experience, including over 27 years in private equity. Mr. Kumar serves as Chief Finance Officer of Jacob Ballas India Private Limited (JBI), a leading India focused mid-market growth private equity advisor based in New Delhi. JBI has been an investment advisor to offshore private equity funds and investments of over $540 million across 30 companies. At JBI, Mr. Kumar has been extensively involved in heading operations, investment structuring, portfolio management, exits, regulatory, legal and compliance matters, finance, accounts and tax. Previously, he has also worked in the non-banking financial company (NBFC) and manufacturing sectors. His previous experience includes managing finance and accounts, fixed deposits operations and conducting feasibility studies for equity /debt placement at Siel Financial Services, Narang Group and Gujarat Ambuja Cement Limited (erstwhile Modi Cement Limited). Associate member of the Institute of Cost Accountants of India and holds a degree in law (LLB)

Founder & Partner

New Delhi

Sachin is a senior growth strategy and corporate development (M&A) leader with proven track record of over 16 years across Software, Communication Tech and IT. He has served as Director- Corporate Development at HCL Tech, where he led numerous cross-boarder M&A transactions and corporate venture investments mandates. During this time, he was personally mentored by Shiv Nadar (founder & chairman of HCL Tech) and appointed as the Director of inorganic strategy to build a billion-dollar business in Software Products & Platforms. He completed $3bn M&As & helped build India’s largest software business inorganically (HCL Software with Revenue of $1.4bn) leading to $12bn HCL Tech’s pivot to one of the largest IP led solution companies. He also led the development of HCL Tech’s first ever Alliance Program to target cross-sell & sell-with in HCL Tech’s 10 biggest client accounts, resulted in significant revenue growth in the inaugural year. This program later formed the foundation for HCL’s largest account management restructuring across top 100 accounts. He is a founding partner of Indus Global Techventures LLP, an India focused tech growth capital and M&A advisory firm. He has been a founding team member, in the capacity of an advisory partner to the sponsor of NASDAQ listed Vahanna Tech Edge Acquisition I Corp. ($200mn), which merged with Roadzen Inc. in $683mn pre-money Equity Value transaction in September 2023. He has also been sole M&A Advisor to Analytics Edge which is recently acquired by C5i in all cash transaction of $30-40mn. Previously, he worked with Infosys Consulting (Management Consulting Services), Nokia Siemens Network and VC-funded US headquartered- Azaire Networks in management consulting and product development roles.

Founder & Senior Partner

New Delhi

Saurav is a senior global business leader with 4 decades of global expertise across Technology, CPG/FMCG, and consumer durables. In two decades in the technology sector with HCL (2000-2019), he has held multiple leadership roles as the Founding President of HCL’s startup enterprise networking firm, led a team that established what has now become a multi-hundred million dollar IT enabled services (“ITES”) business, and served as President of HCL’s ITES North American business. He last served as President of Global Strategy at HCL, and worked on several large tech deals, helped $12 bn global HCL Tech to pivot to a leading IP led solutions company through $3bn B2B software M&A.

With his deep access into global leading private equity / VC firms, Saurav created large groundbreaking value-based partnerships between HCL and PE portfolio tech companies. He also serves as a board member of Goodricke Group Ltd., Accelya Solutions India Ltd., (both listed in India), and Bridgeweave Ltd, UK, an AI based Fintech firm. He is former chairman of NASDAQ listed Vahanna Tech Edge Acquisition I Corp., which merged with Roadzen Inc. in $683mn pre-money EV transaction. He is currently a board member of Roadzen Inc.

His prior experience also includes several senior global leadership and executive roles across Unilever, PepsiCo and with Groupe SEB as CEO of the India business.

Founder & Managing Partner

New Delhi

Srinivas is a career investment professional with over 35 years of corporate experience, including over 26 years in private equity investing in India and SE Asia. He has been involved in investments of over $600 million in over 30 companies, spanning IT, Healthcare, Fintech, Financial Services, Manufacturing and Infrastructure sectors. Srinivas’ private equity career has been mainly with Jacob Ballas India Private Limited (JBI), New Delhi, a leading India focused mid-market growth private equity advisor, as Managing Director and CEO. Previously he served with HSBC Private Equity Asia Limited in Hong Kong and India. Besides investing, he has also led fundraising/investor relations with institutional investors and family offices in USA, Europe, Middle East, SE Asia and Japan. His prior corporate experience includes senior roles at HCL Technologies Group, in the IT sector, and at SRF Finance in investment banking and corporate lending. Srinivas also has extensive corporate board and committee experience. He has been an investor nominee director in leading portfolio companies engaged in diagnostic lab networks, generic pharmaceuticals, IT services, fintech, financial services, manufacturing and infrastructure. In his personal capacity, he is an active angel investor and with investments in sectors such as consumer, e-commerce, edu-tech, food-tech and manufacturing.